Banking-as-a-Service (BaaS) Platform Market By Solution (Banking as a Service Platform, Banking as a Service APIs, Services), Enterprise Size (Small & Mid-sized Organizations, Large Organizations), End User (Banks, FinTech Corporations, Investment Firms) & Region - Forecast to 2024 - 2034. The banking as a service (BaaS) platform market in the United States is expected to develop at a 14.8% CAGR through 2034.

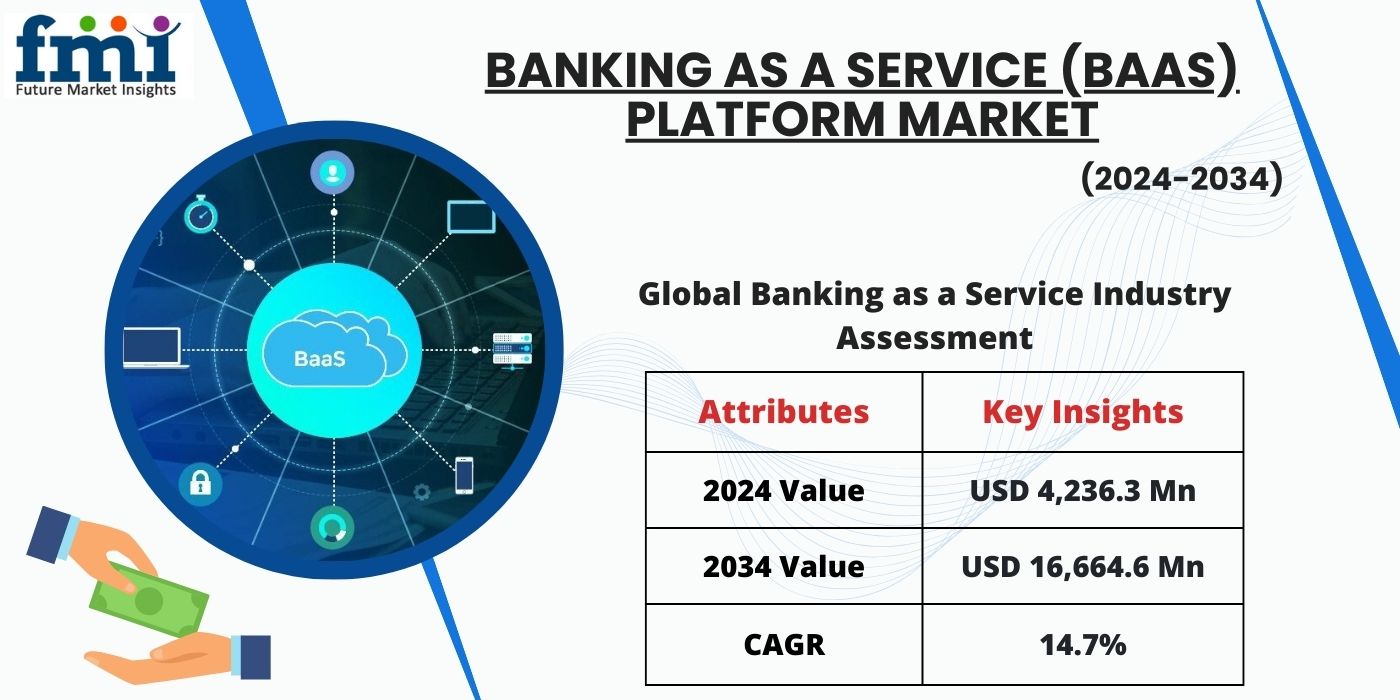

NEWARK, DE / ACCESSWIRE / August 26, 2024 / The Global Banking as a Service (BaaS) Platform Market is expected to reach an impressive USD 4,236.3 million in 2024, according to recent market analysis. The demand for BaaS platforms is projected to rise at a remarkable CAGR of 14.7% from 2024 to 2034, driving the market to an anticipated value of USD 16,664.6 million by the end of 2034.

Banking as a Service (BaaS) is an end-to-end model that allows digital banks and third-party providers to seamlessly connect with traditional banks' systems via Application Programming Interfaces (APIs). This connection enables these entities to build banking offerings on top of the banks' regulated infrastructure, thereby unlocking new opportunities in the open banking landscape that is rapidly transforming Europe's financial services sector.

The BaaS platform plays a crucial role in ensuring the safe communication of data between traditional banks and businesses or fintech companies. By adopting a BaaS platform, banks and financial services providers can concentrate on their core competencies delivering products, services, and customer experiences while benefiting from the expertise, functionality, infrastructure, platform, and scale provided by software providers.

This approach not only reduces development time and costs but also offers a unified view of the customer by leveraging a common platform across a wide range of products and services.

The banking as a service (BaaS) platform market is facing significant challenges due to the rising incidents of cyber-attacks and data breaches. High-profile cyberattacks, such as the 2022 breach of the Bank of Brazil, which compromised their online systems and customer data, underscore the critical vulnerabilities within the industry related to data privacy and cybersecurity.

BaaS providers, who offer essential banking services through APIs, are particularly vulnerable to these threats. The interconnected nature of their systems makes them attractive targets for cybercriminals, amplifying the risks associated with data breaches.

One of the most pressing challenges in safeguarding client information within the BaaS sector is the reliance on third-party vendors. These vendors manage crucial aspects of the banking infrastructure, such as data storage and transaction processing. A breach in any of these third-party systems could potentially expose sensitive client information, including personal and financial data, to unauthorized access.

How is Rising Adoption of Digital Banking Services Affecting Demand for Banking-as-a-Service (BaaS) Platform?

Digital banking or Digitalization of a bank has radically altered the landscape of banking in the last few years. Digital technologies which were initially limited to banking channels, now encompass the entire core banking solution spectrum. Whether it is back-end operations or customer facing channels, digital banking delivered through new-age technologies is the way forward for all participants in the financial service industry.

The current wave of digital transformation is being driven by newer technologies such as Artificial Intelligence, Robotic Process Automation, Blockchain, API Banking, and Internet of Things which have the potential to dramatically alter the banking landscape. These technologies, when harnessed together, will be able to provide much deeper levels of personalization and enhanced customer experience, transform the banking operations, changing the very essence of how the banking industry operates today.

In addition, increasing awareness regarding the internet banking is also driving the growth of BaaS market. As customers are using internet banking to access a variety of services, including 24-hour banking, cash transfers, balance checks, account statements and online purchases, providing these services is undoubtedly more reliable.

Get Full Report Now: https://www.futuremarketinsights.com/reports/banking-as-a-service-baas-platform-market

Key Takeaways from the Market Study

The global banking as a service (BaaS) platform industry reached USD 3,717.5 million in 2023.

The industry demonstrated a robust growth rate with a CAGR of 13.9% from 2019 to 2023.

Germany's BaaS market is projected to continue growing at a CAGR of 13.9% through 2034.

The BaaS market in the USA is expected to expand even faster, with a CAGR of 14.8% through 2034.

Globally, the BaaS platform market holds a significant market share, estimated to be between 35% and 40%.

Competitive Landscape

In July 2024, Avidia Bank formed partnership with Q2 Software Inc, for digital banking platform. Avidia will upgrade its online banking capabilities and adopt Personetic's AI-powered engagement engine through its partnership with Q2 digital banking platform. This will allow Avidia to provide real-time insights and automated saving plans.

In July 2024, Saudi Central Bank (SAMA) launched a new government banking service platform named "Naqd". The platform will enable government agencies to easily access their accounts at the central bank as well as conduct secure financial transactions on a digital platform.

In February 2024, UK-based digital investment platform Wealthify formed partnership with ClearBank. The former company will leverage ClearBank's embedded banking service to introduce a new instant-access savings account.

Key Players of Banking as a Service Industry

Goldman Sachs

Sopra Banking Software

Bnkbl Ltd

Treezor

Solarisbank AG

Clearbank Ltd

Q2 Software, Inc.

Green Dot Corporation

Webster Bank

BBVA S.A.

Unit Finance, Inc.

Starling Bank

Treasury Prime

ADVAPAY OÜ

Technisys

Key Segments of Banking as a Service Industry

By Solution:

In terms of Solution, the industry is segmented into Banking as a Service Platform, Banking as a Service APIs and Services.

By Enterprise Size:

The Enterprise Size is segregated by Small & Mid-sized Enterprises and Large Enterprises.

By End User:

The End User is classified by Banks, FinTech Corporations, Investment Firms and Others.

By Region:

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA) have been covered in the report.

Author By:

Sudip Saha is the managing director and co-founder at Future Market Insights, an award-winning market research and consulting firm. Sudip is committed to shaping the market research industry with credible solutions and constantly makes a buzz in the media with his thought leadership. His vast experience in market research and project management a consumer electronics will likely remain the leading end-use sector cross verticals in APAC, EMEA, and the Americas reflects his growth-oriented approach to clients.

He is a strong believer and proponent of innovation-based solutions, emphasizing customized solutions to meet one client's requirements at a time. His foresightedness and visionary approach recently got him recognized as the ‘Global Icon in Business Consulting' at the ET Inspiring Leaders Awards 2022.

Have a Look at the Related Reports of the Technology Domain:

The embedded banking outlook highlights rapid integration of financial services into non-banking platforms, driving customer engagement, enhancing user experiences, and fostering new revenue streams across industries.

The expansion of merchant banking services is driven by increased demand for financial advisory, capital raising, and specialized investment solutions in a rapidly evolving global economic landscape.

The rising demand for blockchain in banking is driven by its potential to enhance transaction security, reduce fraud, and streamline operations through decentralized, transparent financial systems.

A Core Banking Solution streamlines financial operations by centralizing transaction processing, account management, and customer service, enabling banks to offer seamless, real-time banking services across multiple channels.

The global content service platform market is set for significant expansion, with an anticipated valuation of USD 72.3 billion by 2024. The market displays a trend featuring a CAGR of 17.6%, which is expected to endure until 2034.

The global video processing platform market is expected to grow at a CAGR of 18.5% during the projected period. The market value is projected to increase from USD 8.3 billion in 2024 to USD 45.0 billion by 2034.

A Digital Risk Protection Platform proactively identifies, monitors, and mitigates online threats, safeguarding an organization's digital assets and reputation from cyber risks across various digital channels.

Expanding at an impressive CAGR of 18.2%, the global digital commerce platform market is projected to surge from a valuation of USD 9.61 billion in 2023 to USD 51.16 billion by 2033.

The rising popularity of Buy Now Pay Later platforms is driven by consumer demand for flexible payment options, fueling significant growth in e-commerce and retail sectors.

The global smart home platforms market size was valued at USD 20.5 Billion in 2021 and is expected to expand at a CAGR of 16.5% to reach US$ 110 Billion from 2022 to 2032.

About Future Market Insights (FMI)

Future Market Insights, Inc. (ESOMAR certified, recipient of the Stevie Award, and a member of the Greater New York Chamber of Commerce) offers profound insights into the driving factors that are boosting demand in the market. FMI stands as the leading global provider of market intelligence, advisory services, consulting, and events for the Packaging, Food and Beverage, Consumer Technology, Healthcare, Industrial, and Chemicals markets. With a vast team of over 400 analysts worldwide, FMI provides global, regional, and local expertise on diverse domains and industry trends across more than 110 countries.

Contact Us:

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware - 19713, USA

T: +1-845-579-5705

For Sales Enquiries: sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

LinkedIn| Twitter| Blogs | YouTube

SOURCE: Future Market Insights Inc.

View the original press release on accesswire.com