- Files 10Q/A for the Third Quarter Fiscal Year 2021

- Increase in net income and EPS due to tax-related benefit of $0.5 million;

- Full-year fiscal net income and EPS will not be affected by this change

NEW YORK, NY / ACCESSWIRE / November 5, 2021 / Zedge, Inc. (NYSE AMERICAN:ZDGE), a global app publisher with a portfolio of leading digital consumer brands serving 43 million monthly active users in October 2021, today announced that it has filed a 10Q/A with the SEC for the third quarter of fiscal 2021 ended April 30, 2021.

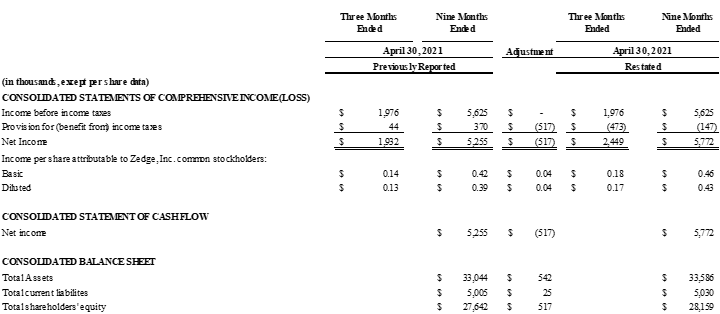

The amended filing reflects a net impact of adding $0.5 million to net income, or $0.04 to earnings per share (EPS) for the quarter and the nine-month period ended April 30, 2021. The improved results relate to the release of a valuation allowance on the Company's deferred tax asset. This will have no impact on full-year fiscal 2021 net income or EPS and the Company maintains the change was due to a timing issue and would have otherwise recognized this benefit in its fourth quarter fiscal 2021 results and been reflected in its Form 10-k for fiscal 2021. As a result, the Company has identified a material weakness in disclosure controls and procedures over the evaluation of the valuation allowance against deferred tax assets, which has been outsourced to an outside accounting firm since fiscal 2018. The Company is working diligently with its auditors to address their concerns and remdiate the situation as quickly as possible. Below is a summary of the impact of these changes on the Company's financial statements for the period ended April 30, 2021:

The partial results below are for the fiscal fourth quarter and full-year 2021 and were provided on October 27, 2021.

Select Fiscal FourthQuarter Highlights (Fiscal 2021 versus Fiscal 2020)

- Revenue increased 93.0% to $5.2 million versus $2.7 million;

- Active subscriptions1 and subscription revenue increased 49.2% and 55.0%, respectively;

- Operating income and operating margin of $2.2 million and 42.2% versus $0.4 million and 14.4%, respectively;

- MAU increased by 7.8% to 34.4 million; ARPMAU1 increased 76.3% to $0.05;

- Zedge Premium Gross Transaction Value1 (GTV) of $0.3 million an increase of 45.0%.

Select Full-Year Fiscal 2021 Highlights (versus Fiscal 2020)

- Revenue increased 106.6% to $19.6 million versus $9.5 million;

- Active subscriptions and subscription revenue increased 49.2% and 100.8%, respectively;

- Operating income and operating margin of $7.8 million and 39.9% versus an operating loss of ($0.4) million and (4.2)%, respectively;

- Zedge Premium GTV of $0.95 million an increase of 29.8% versus last year.

1We use the following business metrics in this release because we believe they are useful in evaluating Zedge as an investment.

- Monthly active users, or MAU, captures the number of unique users that used our Zedge app during the previous 30-days of the relevant period, is useful for evaluating consumer engagement with our app which correlates to advertising revenue as more users drive more ad impressions for sale. It also allows readers and potential advertisers to evaluate the size of our user base;

- Average Revenue Per Monthly Active User, or ARPMAU, is a useful statistic in evaluating how well we are monetizing our user base;

- Zedge Premium Gross Transaction Value, or GTV, is the total dollar amount of transactions conducted through the Zedge Premium Marketplace. As Zedge Premium is an internal focus for growth, we believe that this metric will help investors evaluate the progress we are making in growing this part of our business;

- The term Active Subscriptions is replacing "paid subscriptions" due to changes made by Google Play with respect to how they calculate subscriptions. An active subscription is a subscription that has commenced and not been canceled, including paused subscriptions, and subscriptions in free trials, grace periods, or account hold.

About Zedge

Zedge owns a portfolio of leading digital consumer brands that serve 43 million monthly active users in October 2021 across the globe. Our portfolio consists of Zedge Ringtones and Wallpapers, the leading mobile app used for mobile phone personalization, social content, and fandom art; Zedge Premium, a marketplace for artists, celebrities, and emerging creators to market their digital content, to Zedge's users; Emojipedia, the leading source of all things emoji; and Shortz, a mobile entertainment app in beta, focused on short-form storytelling. Zedge monetizes its content through ad-supported offerings, tokens, and subscriptions. For more information, visit https://www.zedge.net.

Forward-Looking Statements

All statements above that are not purely about historical facts, including, but not limited to, those in which we use the words "believe," "anticipate," "expect," "plan," "intend," "estimate," "target" and similar expressions, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. While these forward-looking statements represent our current judgment of what may happen in the future, actual results may differ materially from the results expressed or implied by these statements due to numerous important factors. Our filings with the SEC provide detailed information on such statements and risks and should be consulted along with this release. To the extent permitted under applicable law, we assume no obligation to update any forward-looking statements.

Contact:

Brian Siegel IRC, MBA Managing Director

Hayden IR

(346) 396-8696

ir@zedge.net

SOURCE: Zedge, Inc.

View source version on accesswire.com:

https://www.accesswire.com/671432/Zedge-Announces-Revised-Results-for-Third-Quarter-Fiscal-Year-2021-Reported-Diluted-EPS-Should-Have-Been-004-Higher-at-017-versus-013-as-Originally-Reported