In response to the escalating problem of fraud and chargebacks impacting small businesses, particularly nail salons and spas, the Department of Bank Card (DBC) has announced a groundbreaking initiative aimed at protecting these vulnerable enterprises. As one of the first governmental bodies to address this issue comprehensively, the DBC’s new program seeks to provide vital support and resources to businesses grappling with the financial and operational challenges of fraudulent transactions and disputes.

Addressing a Growing Crisis

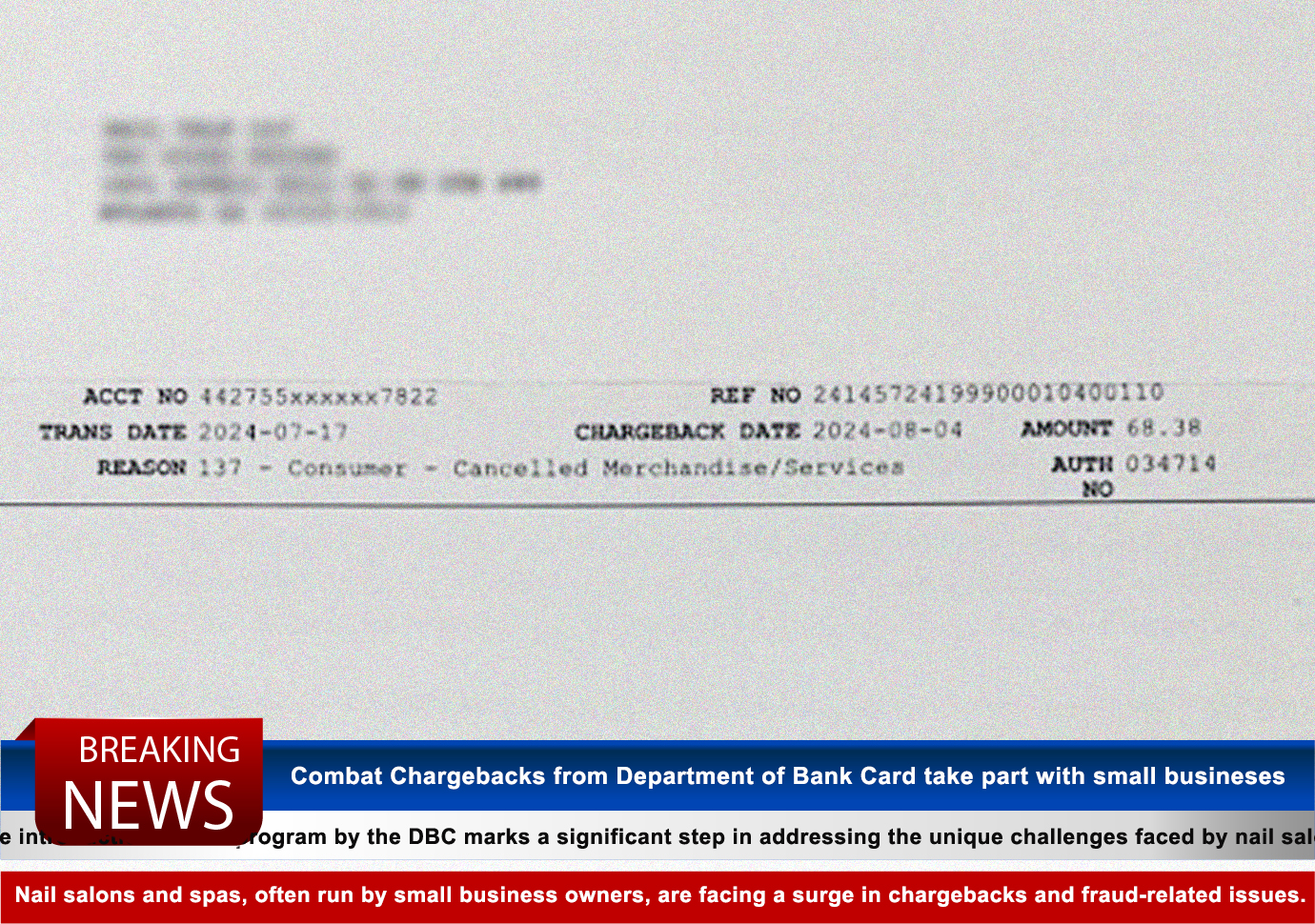

Nail salons and spas, often run by small business owners, are facing a surge in chargebacks and fraud-related issues. These challenges are exacerbated by the personal nature of their services and high transaction volumes. Vietnamese-owned establishments, in particular, are experiencing heightened vulnerability, with many facing severe financial repercussions due to these problems.

Recent data underscores the gravity of the situation. The 2023 Chargeback Guide by Chargebacks911 reports that the beauty industry, including nail salons and spas, is experiencing chargeback rates up to 0.5%, significantly higher than the average rate of 0.2% across other sectors. Additionally, the Visa 2023 Global Fraud Benchmark Report highlights that businesses in this sector are frequently targeted for fraudulent activities, leading to substantial financial losses.

DBC’s Comprehensive Program

In response to these pressing issues, the Department of Bank Card has unveiled a multifaceted program designed to safeguard small businesses from fraud and chargebacks. The program includes several key components:

- Fraud Prevention Workshops: The DBC will offer a series of workshops and webinars focused on educating nail salon and spa owners about the latest fraud prevention techniques and cybersecurity measures. These sessions will cover topics such as secure payment processing, identifying phishing scams, and implementing effective fraud detection tools.

- Chargeback Assistance: The program will provide specialized support for businesses dealing with chargebacks. This includes guidance on how to properly document transactions, build compelling cases for chargeback representment, and navigate the dispute resolution process.

- Enhanced Security Measures: The DBC is partnering with leading cybersecurity firms to offer discounted security solutions for small businesses. These measures include advanced fraud detection systems and secure payment gateways, designed to protect businesses from unauthorized transactions.

- Financial Relief Programs: Recognizing the financial strain that chargebacks and fraud can impose, the DBC is introducing financial relief programs to assist affected businesses. This support includes grants and low-interest loans aimed at helping salons and spas recover from financial losses related to fraud.

- Public Awareness Campaigns: The DBC will launch a nationwide awareness campaign to inform consumers about the impact of fraudulent chargebacks on small businesses. This initiative aims to foster greater understanding and encourage fair practices among customers.

A Supportive Response to a Critical Need

The introduction of this program by the DBC marks a significant step in addressing the unique challenges faced by nail salons and spas. For small business owners like Mai Nguyen of Nguyen Salon in Houston, this initiative offers a much-needed lifeline. Nguyen, who recently faced a wave of chargebacks following a cybersecurity breach, welcomes the DBC’s support as a crucial measure to safeguard her business.

“The financial and emotional toll of dealing with chargebacks and fraud has been overwhelming,” Nguyen says. “The DBC’s new program provides hope and practical solutions that will help us protect our business and continue serving our community.”

Looking Ahead

As the Department of Bank Card rolls out this comprehensive program, it represents a proactive and supportive approach to a growing issue. By equipping small businesses with the tools and resources they need to combat fraud and manage chargebacks, the DBC is setting a precedent for effective intervention and support.

In conclusion, the DBC’s initiative underscores a critical response to the urgent needs of nail salons and spas across the country. With its focus on education, financial relief, and enhanced security, the program promises to make a significant difference in helping these businesses navigate the complex landscape of fraud and chargebacks.

Media Contact

Company Name: US Department of Bank Card

Contact Person: Mathew Aarona

Email: Send Email

Country: United States

Website: www.us-dbc.org