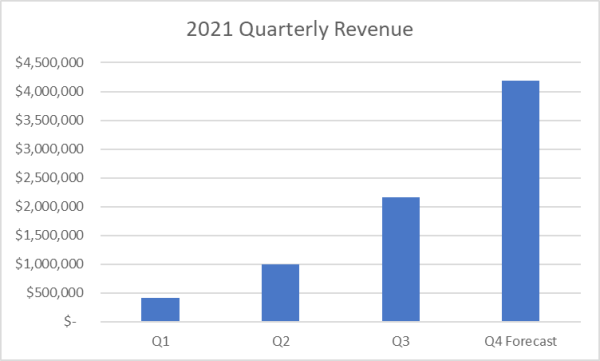

Digital Brands Group, Inc. (NASDAQ: DBGI) stock was higher by about 35% since the middle of August. But, after announcing earnings earlier this morning, that number jumped to 65%. And deservedly so. DBGI generated $2.2 million in revenues, a roughly 75% increase over the prior quarter. Better still, guidance is bullish, with DBGI CEO Hil Davis expecting to double revenues again in Q4 to at least $4 million.

Keep in mind, that growth comes at one of the most challenging times in the apparel sector history, which has been hit with pandemic-related consumer restrictions and massive logistical challenges. Thus, while Q4 appears set up to enjoy another dose of healthy revenue growth, 2022 is likely to be the breakout year. And with that being less than two months away, taking advantage ahead of the expected growth may be wise.

The more excellent news is that improving business trends should put a tailwind at DBGI's revenue-generating back. The chart used in its report highlights an impressive trend. Moreover, its sum of the parts presentation shows an asset portfolio accelerating its brand and market presence. Still, while its quarterly growth is impressive, guidance for 2022 is even better.

Source: Digital Brands Group, Inc.

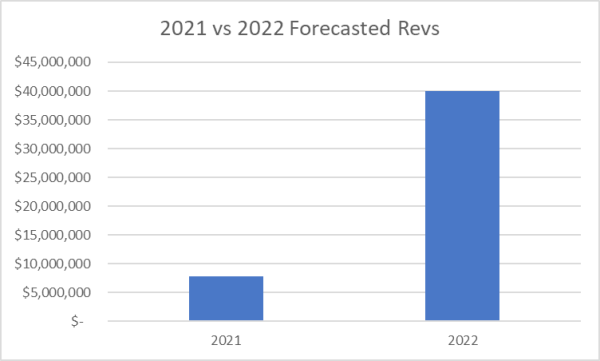

There, DBGI reiterated that it expects to generate between $37.5- $42.5 million in sales during FY 2022. That represents a more than 350% increase over its 2021 projections. Better yet, DBGI is forecasting positive EBITDA for the new year as well, leveraging the power inherent to its shared services platform. That's not all. The best part of the guidance is that all its brands are in hyper-growth mode. Hence, as DBGI noted in its report, its forward-looking guidance reflects the power of its entire brand portfolio, including the benefits of earning full-year revenue contributions from its acquisitions in 2021.

By the way, it's important to note that the forecasted 350% increase in FY 2022 revenues does not reflect any potential additional acquisitions. Moreover, it doesn't reflect the expected meaningful benefit from its rise in marketing spending.

Last month, DBGI reported its Bailey 44 brand saw a 379% surge and DSTLD a 52% jump in revenues after spending only a fraction of its ad budget. They noted, in fact, that as of that date, it has spent only about $30,000 of a marketing budget of roughly $500,000. Hence, the dollar-to-dollar returns are more than impressive. They also show that its campaigns are targeting the right markets at the right times.

Perhaps the best news of all is that revenues are falling faster toward the bottom line. DBGI said its gross profit margin increased 96% year over year to 55.9% from negative 40.1%. That put gross profit higher to $1.7 million due to improved gross margins at all its brands. Thus, with its shared services platform adding efficiencies and cost savings, positive results are in the crosshairs to reach EBITDA.

Source: Digital Brands Group, Inc.

Further, with a stable of compelling brands, confidence is high that those results will accrue sooner than later. Still, assuming DBGI follows through on its S-1 ambitions, it's likely more brands will be added, which could also make its current forecasts conservative.

So, how good does its brand portfolio look? In one word- excellent.

Brands That Combine Luxury With Modern Lifestyle

Driving the growth at DBGI comes through at least four brands. All are unique, and all can add considerable value.

Thus, the content below isn't a commercial. In fact, it shows why the DBGI brand portfolio offers considerable value at current prices. Each brand is unique, powerful, and targets the appeal of a generation focused on quality, comfort, and sustainable processes. Thus, by understanding its brands, the value is exposed. Here they are:

-DSTLD (dis-tilld)

Its DSTLD brand is a favorite of those that enjoy the lived-in feel of soft premium denim. But, while simple sounding, DSTLD takes its mission very seriously, positioning its apparel as an attitudinal staple that should be comfortable, wearable, and most of all allow people to feel like themselves when they wear it. In addition, by standing for quality over quantity, DSTLD designers seek to create consciously minimal designs that are edited for everyday life. And its collections show that intent.

Not only that, its inherent design principles, inspired by the scientific method and creative process, motivate the company to continually examine, explore, and express a distilled vision of what a core wardrobe should be. And unwavering in their pursuit of methodical expertise, they focus on purified fits, premium fabrics, manufacturing integrity, and sustainability practices.

Best of all, its team comes together embracing a robust blend of analytical and creative backgrounds, leading to a mixture of experience and thought that facilitates a driven approach to constantly improve its collections and commit to focusing on what matters most - both in clients closets and in life. Check out DSTLD's most current apparel here.

-Bailey 44

Bailey 44 apparel is a beauty from every direction. And while it only contributed about six months of revenue this year, it can help DBGI sales to surge in 2022. Moreover, triple-digit-percentage revenue growth is again expected with a sharply increased marketing budget allocated for the brand.

It's likely, especially with Bailey 44 combining beautiful, luxe fabrics and on-trend designs to create sophisticated ready-to-wear capsules for women on the go. The styles are edgy, too, inspired by Los Angeles' urban architecture and iconic landscapes that lead the design team to embed modern details, classic elements, and feminine designs.

For women, by women, the brand is considered "cool sexy classic," with designs styled to be perfect capsules for tropical getaways and early morning meetings. Put simply, Bailey 44 is a brand that makes its clients look and feel great for every stop along their way. As they put it, with Bailey 44, style travels. Check out their attractive lineup of available products here.

-Harper & Jones

DBGI appeals to the masculine side with a collection of premium apparel from Harper & Jones. This luxury, premium lifestyle brand leverages knowledge gained from Europe's finest clothiers and the belief that confidence comes from outside your comfort zone. Its founder, Drew Jones, set out to redefine what quality means with modern American style. Harper & Jones is the result — and his meticulous commitment to quality and manufacturing shows in every piece of custom-made apparel.

The brand combines a bench-made journey with custom-fit and delivery to position itself as a premium clothier embracing forward-thinking designs and staying true to its passion of using only luxe fabrics that are responsibly sourced. The brand is expected to grow rapidly under DBGI management, with marketing dollars earmarked to drive sales in 2022. DBGI will enjoy a full year of revenues from the brands next year. Check out why Harper & Jones can be a significant contributor to revenues in 2022 here.

-Stateside apparel

DBGI's most recent acquisition was Stateside apparel. It's an elevated basics brand developed to stylize comfort, colors, and everyday wearability. The brand is influenced by a mix of cultures and attitudes that lead to elevated but straightforward designs that make a statement. Stateside recently added a new product category to bring women's knits and woven tops to the marketplace. So far, sales have been strong.

But, they always were. DBGI has suggested that sales of this brand could top $5 million next year in normal market conditions. Better still, strong margins and efficient supply and distribution channels through its shared services platform should help those revenues fall quickly toward the bottom line.

One of the most attractive features of the brand is its influence from American basics, including the evolution of the classic t-shirt. But, Stateside takes design a step further, using brilliant saturated-dyed finishes that give its styles the soft feel of a perfectly lived-in piece that has been washed and worn to perfection. The collection's weathered color palette includes a range of neutrals (washed-out grays and navy, pure white) as well as faded brights.

And like its other brands, Stateside endorses sustainable manufacturing processes, uses only the best raw materials, and is true to its community by designing and producing in Los Angeles. Smart designs, smart fashion, Check out why Stateside is expected to make a substantial revenue impact here.

Understanding The Brand Foundation

With that knowledge of brands, investors should better see the exposed value proposition. Each brand is exciting, detailed, and targets markets that embrace sustainable practices, comfort, and style. In fact, all brands are loaded with the features necessary to accommodate fast-changing consumer tastes- not only in style but also in how and where they get manufactured.

DBGI's brand portfolio checks all the right boxes. Better still, the value they bring can finally be put side to side to industry comparisons. Recent IPO's of a.k.a Brands (NYSE: AKA) and Solo Brands (NYSE: DTC) help make a case for DBGI to be an $11 stock. How? By employing the same revenues multiple given to AKA during its IPO.

But, more than deserving of the same appreciation, DBGI may be worthy of a premium, noting that its balance sheet and capital structure are more inviting than AKA's. Solo Brands raised about $220 million after being priced at $17 per share. Both of those stocks, by the way, are trading appreciably higher than the IPO prices.

Hence, DBGI, which is in hyper-growth mode, is absolutely deserving of a higher share price. Earlier today, earnings and guidance suggest that the company is well on its way to target the high end of its guidance- $42.5 million next year. So, while the apparel can wear well, the stock can as well in a growth-oriented portfolio.

Indeed, the indicators and performance suggest growth. And with all brands executing well and an S-1 calling for additional acquisitions, DBGI stock is certainly in fashion.

Disclaimers: Level3Trading is responsible for the production and distribution of this content. Level3Trading is not operated by a licensed broker, a dealer, or a registered investment adviser. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The information made available by Level3Trading is not intended to be, nor does it constitute, investment advice or recommendations. The contributors may buy and sell securities before and after any particular article, report and publication. In no event shall Level3Trading be liable to any member, guest or third party for any damages of any kind arising out of the use of any content or other material published or made available by Level3Trading, including, without limitation, any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages. Past performance is a poor indicator of future performance. The information in this video, article, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. Level3Trading strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. For some content, Level3Trading, its authors, contributors, or its agents, may be compensated for preparing research, video graphics, and editorial content. As part of that content, readers, subscribers, and website viewers, are expected to read the full disclaimers and financial disclosures statement that can be found Level3trading.com/disclaimer.

The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be forward looking statements. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quote; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results.Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investors investment may be lost or impaired due to the speculative nature of the companies profiled.

Media Contact

Company Name: Hawk Point Media

Contact Person: Ken Kellis

Email: info@hawkpointmedia.com

Phone: 3057806988

City: Miami Beach

State: Florida

Country: United States

Website: https://www.digitalbrandsgroup.co/