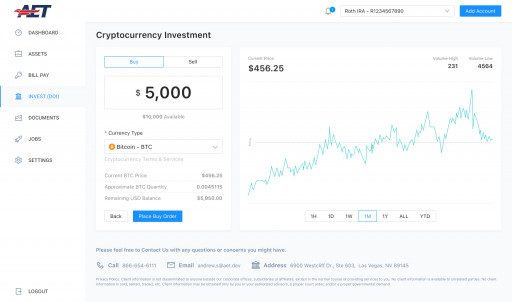

Crypto Trading

Trust Platform's crypto trading feature

LAS VEGAS - March 9, 2022 - (Newswire.com)

American Estate & Trust (AET), a Nevada-based trust company and financial custodian, announced today that it has expanded its capabilities to include cryptocurrency trading as a native feature on its platform. AET's flagship product, Trust Platform, provides a fully digital solution for financial professionals that need to manage self-directed IRAs, Solo 401(k) plans, and a variety of alternative assets for their customers.

Traditional retirement accounts limit investments to publicly traded stocks and bonds. Trust Platform, however, supports self-directed accounts, which let end-users invest in and hold alternative assets like real estate, land, private equity, precious metals - and now crypto - in a tax-advantaged retirement account.

While many custodians focus on facilitating alternative asset investments for individuals, AET is among the few dedicated solely to businesses. "We work with financial advisors, IRA administrators, fund managers, and alternative asset marketplaces that want to give their clients the option to source funds from their IRAs to invest. This is not a new concept. We have just figured out how to streamline the process to provide a pleasant experience for the business and each of their investors," says Summer Webb, AET's Vice President of Business Development.

How does the platform work? The system comes with two separate portals: one for the business to onboard and manage clients, and another for each client to log in, deposit cash, contribute to various self-directed accounts, invest in alternative assets, and receive distributions. The platform also contains a "white-label" feature, where the business can place their brand logo in their client dashboards and host the portal from a custom domain. Additionally, the AET offers an open API for existing platforms that want to incorporate AET's custodial functionality into their product.

"Our focus is to help businesses realize the untapped potential and power of self-directed retirement accounts. We want to give investors the ability to diversify their retirement savings into opportunities they care about most," says Webb.

Cryptocurrency is just one of the many asset types that Trust Platform supports. As the demand for emerging alternative asset classes in professionally managed portfolios continues to grow, AET intends to stay ahead of the curve.

Press Contact: logan@aetrust.com

Press Release Service by Newswire.com

Original Source: Crypto in an IRA? Platform Lets Users Invest Retirement Money Into Digital Currencies