| |||||||||

|  |  |  | ||||||

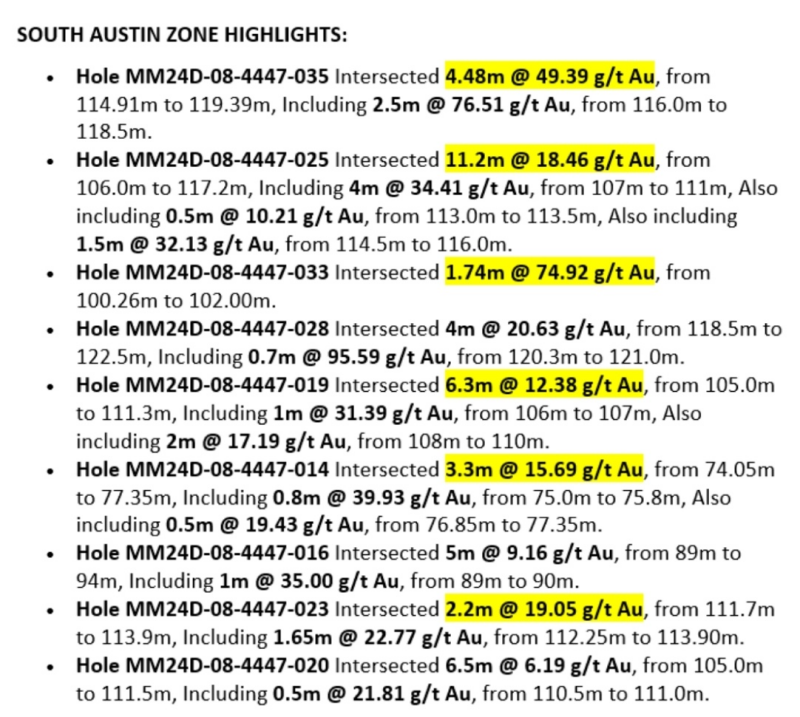

Vancouver, BC, September 26, 2024 – TheNewswire – Global Stocks News – Sponsored content disseminated on behalf of West Red Lake Gold. On September 24, 2024 West Red Lake Gold Mines (TSXV: WRLG) (OTCQB: WRLGF) reported definition drill results focused on the high-grade South Austin Zone.

“This definition drilling is part of the de-risking process ahead of the mine restart,” Will Robinson, VP Exploration told Guy Bennett, CEO of Global Stocks News (GSN). “We’re targeting the highest grade, highest tonnage areas, prioritising the drill stations based on that ranking.”

“A lot of the existing mineral resource at South Austin is built on historic drilling,” Robinson added. “We’ve been able to incorporate that data into the model because we have all the assay certificates, which is not typical for long-lived projects, but speaks to the quality and completeness of our database.”

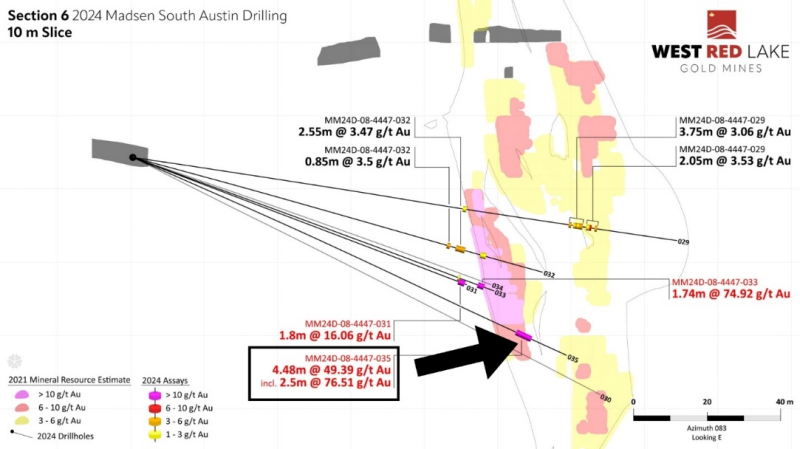

“The tight drill spacing enables us to get a much clearer, more detailed picture of the gold grade distribution, allowing us to refine the local resource models ahead of mine design.”

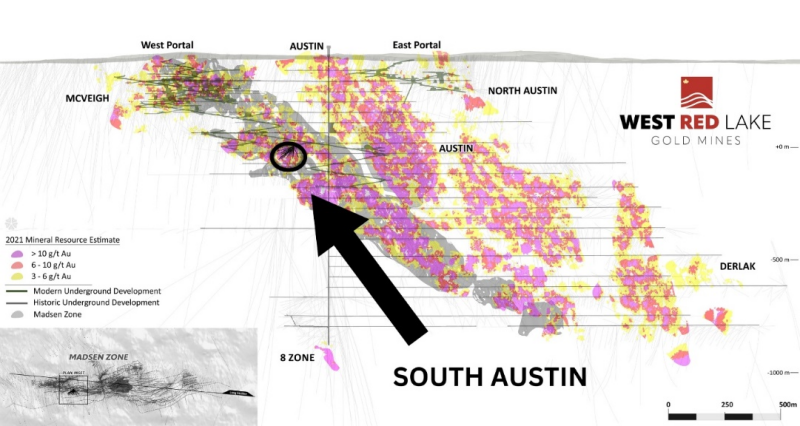

South Austin Zone currently contains an Indicated mineral resource of 474,600 ounces @ 8.7 g/t gold, with an additional Inferred resource of 31,800 @ 8.7 g/t gold.

“The intercepts out of South Austin highlighted in this update are right on par with the exceptional results out of the Austin and McVeigh zones that have been announced over the last month,” stated Shane Williams, WRLG President & CEO. “This consistency and quality between different mineral zones help to demonstrate the potential we see within the entirety of the Madsen deposit.”

Plan maps for the Austin and McVeigh drilling featured in recent news releases can be viewed in the context of this 3-dimensional model.

“The definition drilling results will feed into the mine restart plan,” stated Robinson. “We’re going to be mining a number of active headings at the same time. We anticipate six or seven active headings for the cut & fill portion of the mining, which is smaller tonnage, but tends to be higher grade.”

“This will be supplemented using long hole stoping,” added Robinson. “Which is a mining method that can be applied to larger tonnage areas in the deposit. Material mined from cut & fill and long hole can then be blended to maintain adequate head grades to the mill.”

“Concurrent with the drilling, we are conducting important underground development. The previous operator hauled material up from South Austin through the West Portal. They then needed to cross two county roads to get to the primary crusher and mill. This haulage route was limited to daylight hours for noise and safety compliance.”

“We are building a connection drift which will be used to get the South Austin ore to the surface via the East Portal, which is directly adjacent to the crusher and mill. We anticipate this will give us a significant efficiency boost when mining.”

Above: South Austin section view showing assay highlights for Holes MM24D-08-4447-029 through -035.[1] Holes -033 and -034 broke into historic stopes.

“Gold, traditionally perceived as a haven, has climbed roughly 30% this year, outperforming the benchmark S&P 500 index’s 20% gain,” reported CNN on September 25, 2024.

“That has in part been driven by a jump in demand from central banks including in China, Turkey and India, who have added to their gold piles this year to diversify away from the US dollar,” added CNN.

“JPMorgan Chase researchers said in a note on Monday that they expect the yellow metal to continue running toward their 2025 target price of $2,850 an ounce as the Fed brings down rates.”

WRLG expects to complete a pre-feasibility study (PFS) in support of the mine restart goal in 2025.

“The Madsen Mine PFS has a strong foundation of known variables, because Madsen is already largely built,” Williams told GSN.

“Typically, a PFS makes projections about geo-tech, metallurgy, mining methods, and process choices,” Williams continued. “Because Madsen was in operation recently, we have deep data on many of these factors, so the critical cost inputs for the PFS are actual, not estimated.”

“For the South Austin holes we reported on September 24, 2024 the drill spacing is a tight six to eight meters,” Robinson told GSN. “We’re bringing this deposit to a level of confidence where we can hand the data off to the engineering team for mine-design.”

The Madsen Mine deposit presently hosts an NI 43-101 Indicated resource of 1.65 million ounces of gold grading 7.4 g/t gold and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t gold. [1.] [2.] [3.]

The technical information presented in this news release has been reviewed and approved by Will Robinson, P.Geo., Vice President of Exploration for West Red Lake Gold and the Qualified Person for exploration at the West Red Lake Project, as defined by NI 43-101 “Standards of Disclosure for Mineral Projects”.

Contact: guy.bennett@globalstocksnews.com

Disclaimer: West Red Lake Gold paid Global Stocks News (GSN) $1,500 for the research, writing and dissemination of this content.

Full Disclaimer: GSN researches and fact-checks diligently, but we can not ensure our publications are free from error. Investing in publicly traded stocks is speculative and carries a high degree of risk. GSN publications may contain forward-looking statements such as “project,” “anticipate,” “expect,” which are based on reasonable expectations, but these statements are imperfect predictors of future events. When compensation has been paid to GSN, the amount and nature of the compensation will be disclosed clearly.

References:

-

SRK Consulting. (2021). Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada (West Red Lake Gold Mines, Ed.) [Review of Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada.

-

Mineral resources are estimated at a cut-off grade of 3.38 g/t Au and a gold price of US1,800/oz. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc., and dated June 16, 2023, and amended April 24, 2024. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

-

Mineral resources that are not mineral reserves do not have demonstrated economic viability. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc., and dated June 16, 2023, and amended April 24, 2024. The Madsen Resource Estimate has an effective date of December 31, 2021 and excludes depletion of mining activity during the period from January 1, 2022 to the mine closure on October 24, 2022 as it has been deemed immaterial and not relevant for the purpose of the updated report. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

Copyright (c) 2024 TheNewswire - All rights reserved.