General merchandise retailer Target (NYSE:TGT) missed Wall Street’s revenue expectations in Q3 CY2024 as sales only rose 1.1% year on year to $25.67 billion. Its non-GAAP profit of $1.85 per share was 19.6% below analysts’ consensus estimates.

Is now the time to buy Target? Find out by accessing our full research report, it’s free.

Target (TGT) Q3 CY2024 Highlights:

- Revenue: $25.67 billion vs analyst estimates of $25.9 billion (1.1% year-on-year growth, 0.9% miss)

- Adjusted EPS: $1.85 vs analyst expectations of $2.30 (19.6% miss)

- Adjusted EBITDA: $1.95 billion vs analyst estimates of $2.18 billion (7.6% margin, 10.4% miss)

- Management lowered its full-year Adjusted EPS guidance to $8.60 at the midpoint, a 8% decrease

- Operating Margin: 4.6%, in line with the same quarter last year

- Free Cash Flow Margin: 0.3%, down from 3.2% in the same quarter last year

- Locations: 1,978 at quarter end, up from 1,956 in the same quarter last year

- Same-Store Sales were flat year on year (-4.9% in the same quarter last year) (missed vs expectations of up 1.4% year on year)

- Market Capitalization: $71.87 billion

"I'm proud of our team's efforts to navigate through a volatile operating environment during the third quarter. We saw several strengths across the business, including a 2.4 percent increase in traffic, nearly 11 percent growth in the digital channel, and continued growth in beauty and frequency categories. At the same time, we encountered some unique challenges and cost pressures that impacted our bottom-line performance," said Brian Cornell, chair and chief executive officer of Target Corporation.

Company Overview

With a higher focus on style and aesthetics compared to other large general merchandise retailers, Target (NYSE:TGT) serves the suburban consumer who is looking for a wide range of products under one roof.

Large-format Grocery & General Merchandise Retailer

Big-box retailers operate large stores that sell groceries and general merchandise at highly competitive prices. Because of their scale and resulting purchasing power, these big-box retailers–with annual sales in the tens to hundreds of billions of dollars–are able to get attractive volume discounts and sell at often the lowest prices. While e-commerce is a threat, these retailers have been able to weather the storm by either providing a unique in-store shopping experience or by reinvesting their hefty profits into omnichannel investments.

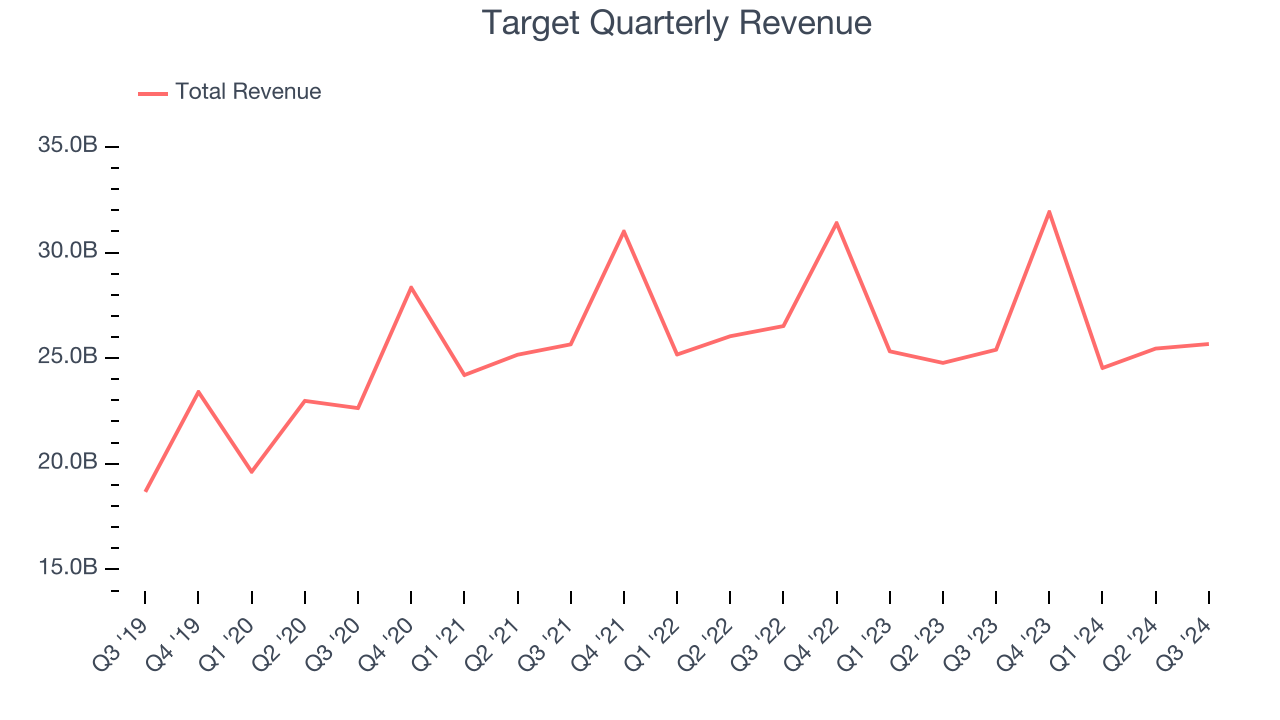

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

Target is a behemoth in the consumer retail sector and benefits from economies of scale, giving it an edge in distribution and the flexibility to offer lower prices. However, its scale is a double-edged sword because it's harder to find incremental growth when you've penetrated most of the market.

As you can see below, Target’s 6.7% annualized revenue growth over the last five years (we compare to 2019 to normalize for COVID-19 impacts) was tepid as it didn’t open many new stores.

This quarter, Target’s revenue grew by 1.1% year on year to $25.67 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 1.3% over the next 12 months, a deceleration versus the last five years. This projection doesn't excite us and implies its products will see some demand headwinds.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Store Performance

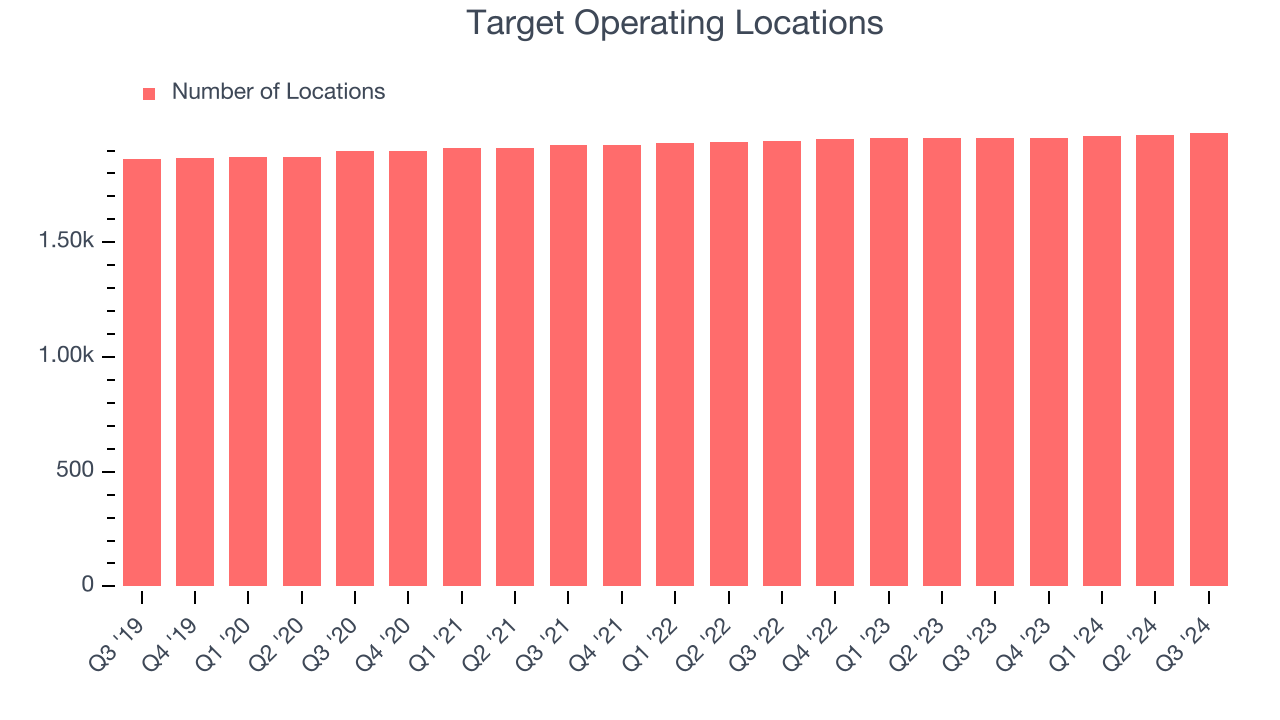

Number of Stores

Target operated 1,978 locations in the latest quarter, and over the last two years, has kept its store count flat while other consumer retail businesses have opted for growth.

When a retailer keeps its store footprint steady, it usually means demand is stable and it’s focusing on operational efficiency to increase profitability.

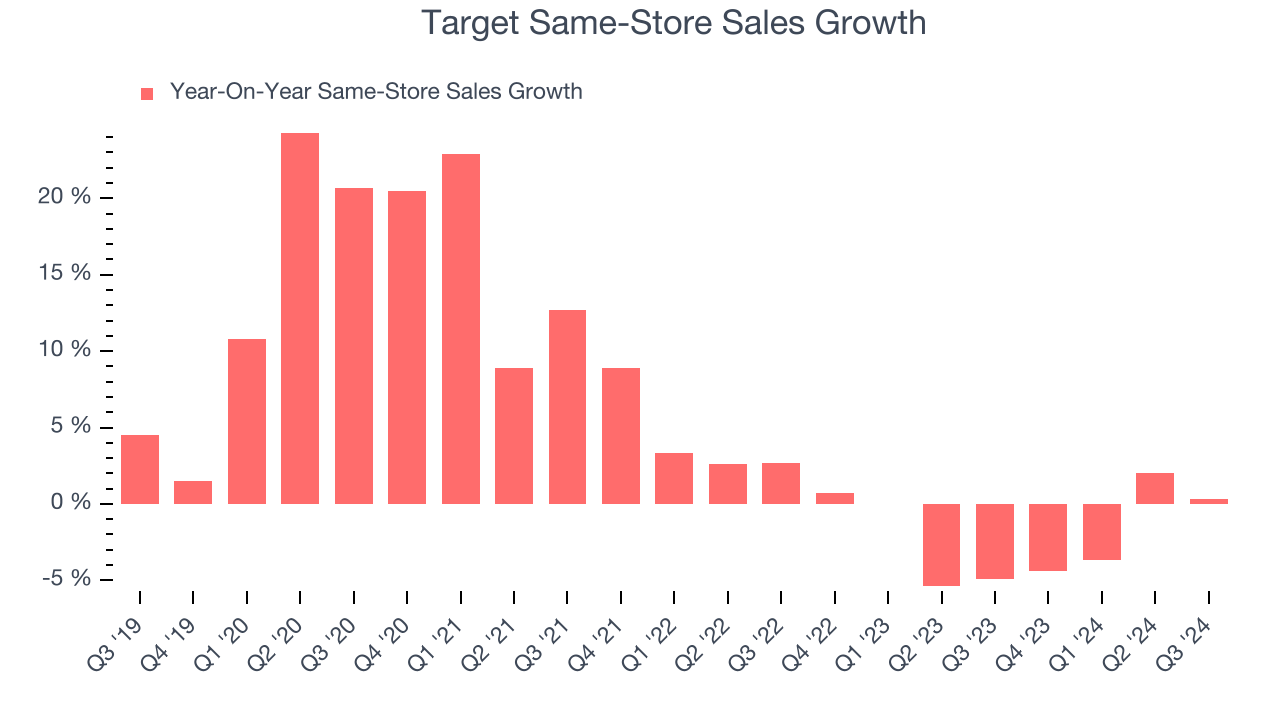

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Target’s demand has been shrinking over the last two years as its same-store sales have averaged 1.9% annual declines. This performance isn’t ideal, and we’d be concerned if Target starts opening new stores to artificially boost revenue growth.

In the latest quarter, Target’s year on year same-store sales were flat. This performance was a well-appreciated turnaround from its historical levels, showing the business is improving.

Key Takeaways from Target’s Q3 Results

We struggled to find many resounding positives in these results. Same-store sales fell short of expectations, leading to a revenue and EPS miss. The EPS miss in the quarter was meaningful. Additionally, Target's full-year EPS guidance was reduced and missed significantly. Overall, this was a surprisingly bad quarter. The stock traded down 21.2% to $123 immediately following the results.

Target may have had a tough quarter, but does that actually create an opportunity to invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.