Aerospace and defense company Rocket Lab (NASDAQ:RKLB) reported Q3 CY2024 results exceeding the market’s revenue expectations, with sales up 54.9% year on year to $104.8 million. On top of that, next quarter’s revenue guidance ($130 million at the midpoint) was surprisingly good and 6.4% above what analysts were expecting. Its GAAP loss of $0.10 per share was also 6.4% above analysts’ consensus estimates.

Is now the time to buy Rocket Lab? Find out by accessing our full research report, it’s free.

Rocket Lab (RKLB) Q3 CY2024 Highlights:

- Revenue: $104.8 million vs analyst estimates of $102.4 million (2.4% beat)

- EPS (GAAP): -$0.10 vs analyst estimates of -$0.11 (beat by $0.01)

- EBITDA: -$30.87 million vs analyst estimates of -$33.34 million (7.4% beat)

- Revenue Guidance for Q4 CY2024 is $130 million at the midpoint, above analyst estimates of $122.2 million

- EBITDA guidance for Q4 CY2024 is $28 million at the midpoint, above analyst estimates of -$28.85 million

- Gross Margin (GAAP): 26.7%, up from 22.1% in the same quarter last year

- Operating Margin: -49.5%, up from -57.4% in the same quarter last year

- EBITDA Margin: -29.5%, down from -23% in the same quarter last year

- Free Cash Flow was $4.57 million, up from -$46.25 million in the same quarter last year

- Market Capitalization: $7.34 billion

Rocket Lab founder and CEO, Sir Peter Beck, said: “In the third quarter 2024 we once again executed against our end-to-end space strategy with successes and key achievements reached across small and medium launch, as well as space systems. Revenue grew 55% year-on-year to $105 million and we continue to see strong demand growth with our backlog at $1.05 billion. Significant achievements for the quarter included signing a launch service agreement for multiple launches on Neutron with a confidential commercial satellite constellation customer; successfully launching twelve Electron launches year-to-date, making 2024 a record year for launches with more still to come; signing $55 million in new Electron launches, further cementing Electron’s position as a global launch leader; and being selected by NASA to complete a study contract for a proposal to retrieve samples from Mars and return them to Earth as part of a world-first mission. We expect to close out the year strongly with more Electron launches scheduled in November and December, alongside continued progress across Neutron and space systems, that is behind our guidance for a record $125-$135 million revenue quarter in Q4.”

Company Overview

Becoming the first private company in the Southern Hemisphere to reach space, Rocket Lab (NASDAQ:RKLB) offers rockets designed for launching small satellites.

Aerospace

Aerospace companies often possess technical expertise and have made significant capital investments to produce complex products. It is an industry where innovation is important, and lately, emissions and automation are in focus, so companies that boast advances in these areas can take market share. On the other hand, demand for aerospace products can ebb and flow with economic cycles and geopolitical tensions, which can be particularly painful for companies with high fixed costs.

Sales Growth

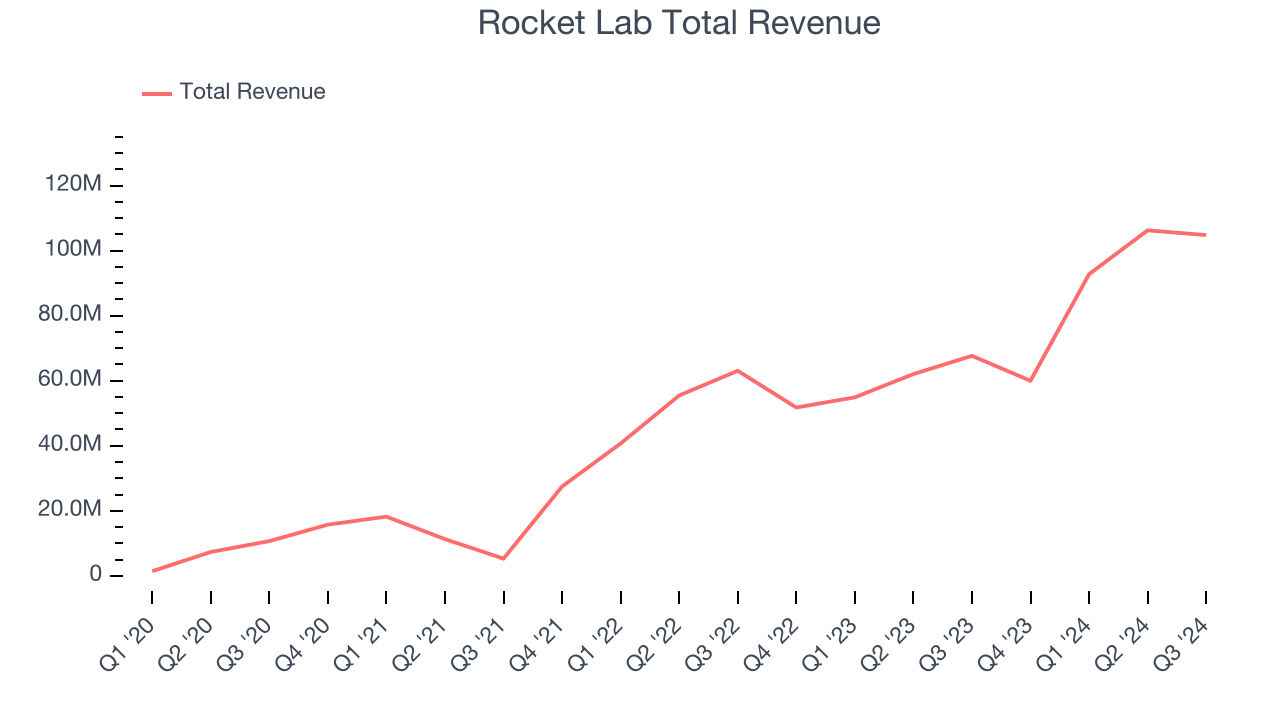

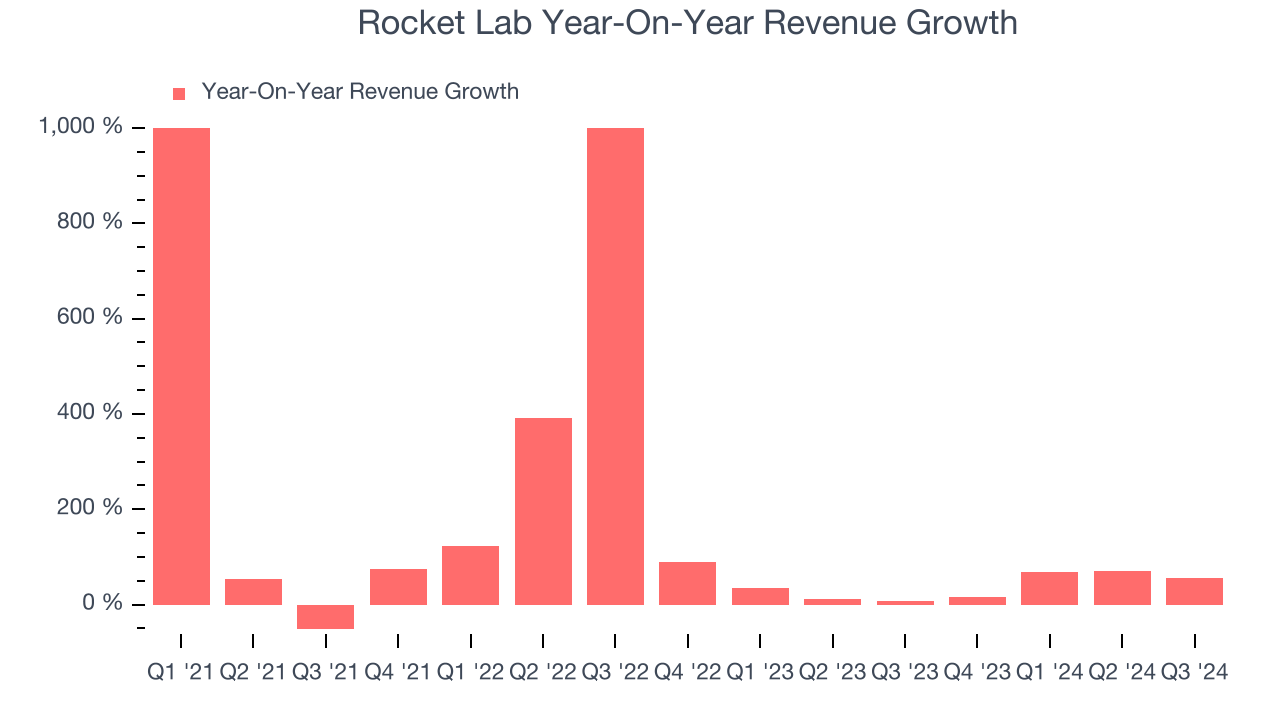

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Over the last four years, Rocket Lab grew its sales at an incredible 98.9% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. Rocket Lab’s annualized revenue growth of 39.6% over the last two years is below its four-year trend, but we still think the results were good and suggest demand was strong.

This quarter, Rocket Lab reported magnificent year-on-year revenue growth of 54.9%, and its $104.8 million of revenue beat Wall Street’s estimates by 2.4%. Company management is currently guiding for a 117% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 47.9% over the next 12 months, an improvement versus the last two years. This projection is healthy and suggests its newer products and services will fuel higher growth rates.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Operating Margin

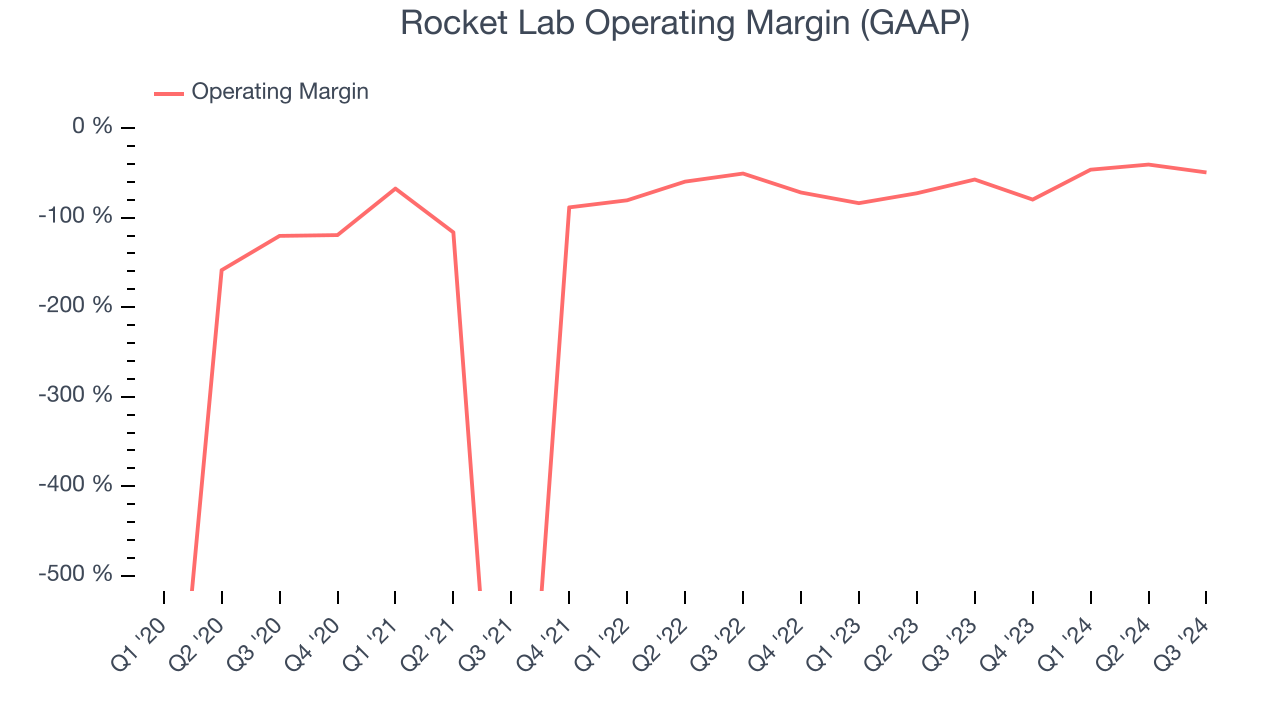

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Rocket Lab’s high expenses have contributed to an average operating margin of negative 71.1% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Rocket Lab’s annual operating margin rose over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

This quarter, Rocket Lab generated a negative 49.5% operating margin.

Earnings Per Share

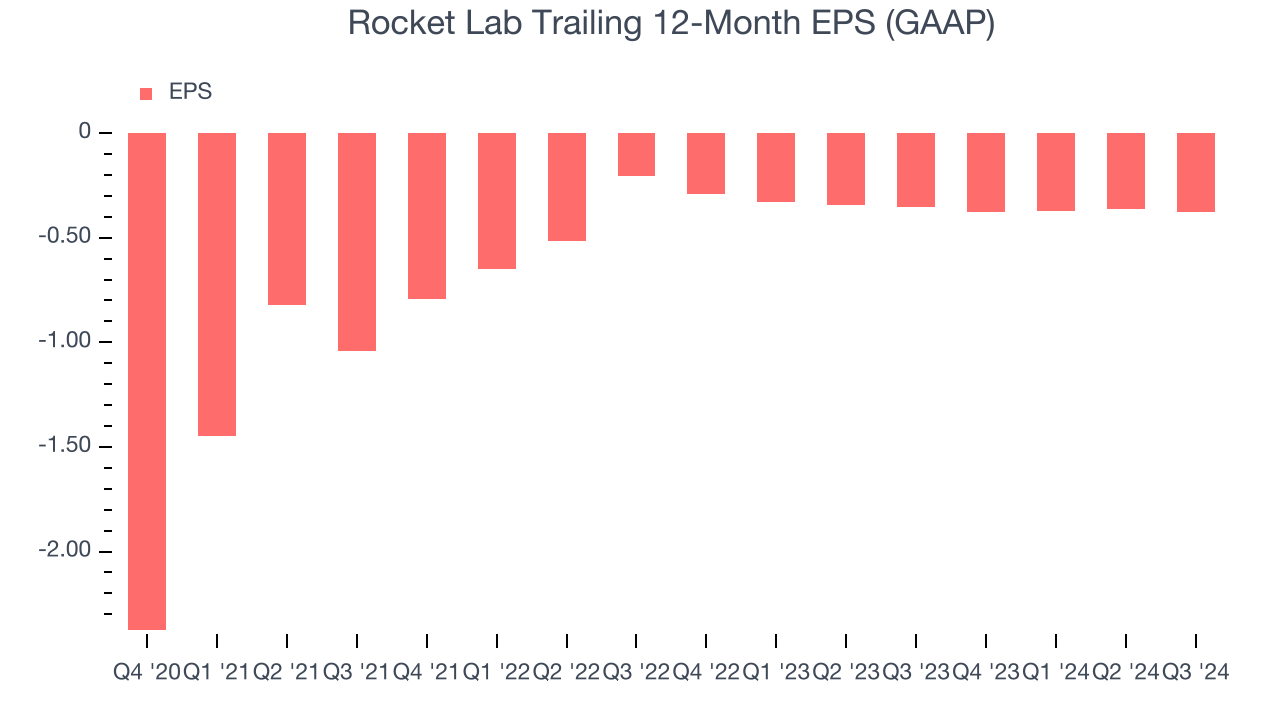

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although Rocket Lab’s full-year earnings are still negative, it reduced its losses and improved its EPS by 40.1% annually over the last four years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For Rocket Lab, its two-year annual EPS declines of 35.6% mark a reversal from its (seemingly) healthy four-year trend. These shorter-term results weren’t ideal, but given it was successful in other measures of financial health, we’re hopeful Rocket Lab can return to earnings growth in the future.In Q3, Rocket Lab reported EPS at negative $0.10, down from negative $0.08 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 6.4%. Over the next 12 months, Wall Street is optimistic. Analysts forecast Rocket Lab’s full-year EPS of negative $0.38 will reach break even.

Key Takeaways from Rocket Lab’s Q3 Results

We were impressed by Rocket Lab’s optimistic EBITDA forecast for next quarter, which blew past analysts’ expectations. We were also excited its revenue and EBITDA both outperformed Wall Street’s estimates in the quarter. Zooming out, we think this was a very good quarter. The stock traded up 16% to $17.00 immediately after reporting.

Indeed, Rocket Lab had a rock-solid quarterly earnings result, but is this stock a good investment here? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.