Gold and copper prices are soaring, reaching record highs in 2024. And that's made investors who took positions in the metals themselves as early as last year look pretty smart. Still, they aren't the only winners. Miners in the sector, junior and senior, have also seen impressive appreciation. That includes U.S. Gold Corp (NASDAQ: USAU), whose shares are currently about 5% higher since the start of April, nearly doubling the gains of gold and easily outpacing the price action of other sector players during the same period. And that's despite a two-day pullback in gold prices that sent the values of nearly every miner lower.

Still, as sector traders know, volatility is ingrained in this sector. However, while accepting that reality, they also tend to recognize that short-term moves often expose opportunities rather than deterrents. In other words, a tough two days for USAU may provide the dip investors need to get a cash-rich USAU at a bargain price. Remember, while the metals' price itself often provides direction, USAU has its own set of value drivers. The biggest is USAU potentially sitting atop vast mountains of reserves—not just at one location but at several—and, better still, at some of the world's most mining-friendly jurisdictions.

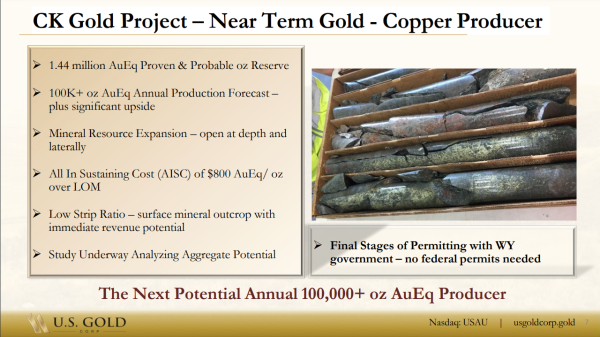

Its projects include its flagship CK Gold, a potentially near-term production facility in Wyoming; Keystone, located 11 miles south of Nevada Gold Mines' Cortez Complex; and its Challis Project, which provides opportunities to unearth gold in the historic Challis volcanic field district southwest of Salmon, Idaho.

Developing Excellent Assets The Right Way At The Right Time

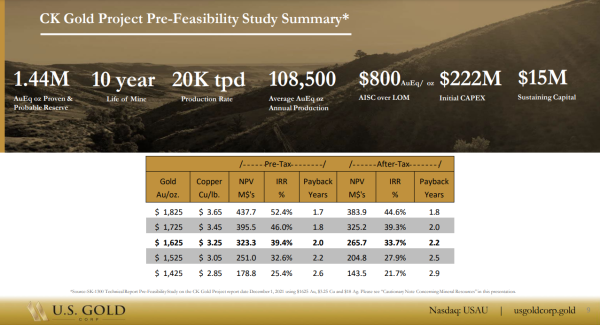

All have tremendous potential, an assessment supported by years of technical and physical analysis that points to significant untapped reserves. But there is a current star of the show- the CK Gold Project, an advanced exploration and development property within Southeast Wyoming's Silver Crown Mining District. This location is more than stunning from a landscape perspective; its grounds may also protect a treasure trove of potential, with the most recent Technical Report and Pre-Feasibility Study estimating 1.01 million proven and probable ounces of gold intertwined with 248 million pounds of copper.

These numbers aren't just figures on a report; properly exploited, they're the promise of a pre-tax net present value of $323 million at report-time prices of $1,625, which, when extrapolated, presents USAU a forecast annual internal rate of return (IRR) of 39.4%. But know this, too: the current price of gold is $2,307, likely making the upside and IRR at the CK Gold Project significantly higher than that report presented, noting they used prices to estimate when gold was below the $1,700 level. Now reflecting as overtly conservative in relation to the rally in gold and copper, the USAU bulls have plenty to be excited about. Adding to that is that the CK Gold Project is racing towards near-term production and, if all goes as planned, enormous value creation.

In other words, re-claiming its 52-week high share price of $5.00 looks more than likely; based on updates, it's probable. That's not unwarranted bullish speculation. It's justified knowing that USAU is unlikely to face environmental roadblocks in its mission to transform from an exploration to a development stage company. That's not a lucky coincidence. It's a logical assumption based on the CK Gold Project designed to run cleaner than most, not using hazardous chemicals, and having no refinery or air-polluting smokestack. In fact, USAU has noted in the press that the hole in the ground made from the dig could be used for water storage for the city of Cheyenne. In addition, USAU believes it can serve another market by selling waste rock, which would deliver more than extra income; the end result closes an open gap related to environmental impact.

USAU Is Well-Positioned To Follow The Lead Of Gold And Copper Bulls

That's an important consideration. And by checking the right boxes before getting to the drilling-stage start line, primarily those environmentally related, value can continuously accrue without unexpected interference. And, yes, USAU has made sure its processes, procedures, and interests align with its development partners, the communities where they work, and with the people who work at its company sites. Surprisingly, that's not always the case in a sector that is often bullied into work-stopping submission. Competing miners, for whatever reasons, sometimes neglect the obvious, which, unfortunately, can lead to massive drains of the capital needed to start and maintain operations. That's NOT the case for USAU.

Its leadership team has taken the proper steps, sometimes at a painstakingly slow pace, to get its company correctly licensed and fundamentally and operationally positioned and able to extract what they expect to be a transformative financial haul for the company. Keep in mind that this is all getting done at the right time. Despite the clashing of talking heads on financial news shows, the most recent April economic indicators point toward a continuation of the bull market for gold and copper into the end of this year. Investors could even see an appreciable uptick in interest in companies like U.S. Gold as a safe haven ahead of what's expected to be a historic and potentially volatile election season leading up to November.

But here's what neither side of the inflation and interest rate debate can hide from: Despite the political spin flavor of the day, report after report shows that while inflation is slowing, it's still hot. And that should generally bode well for gold and, by proxy, U.S. Gold Corp.

After all, historically, gold remains one of the safest plays against inflation. And while higher gold prices can send the share prices of most miners higher, it's also true that some do better than others. USAU proved that's the case in April with its 5% jump. In comparison*, during the same period, Barrick Gold (NYSE: GOLD) moved lower about 1.35% higher, Paramount Gold Nevada (NYSE: PZG) lower by 2.3%, Vista Gold (NYSE: VGZ) closed lower by nearly 9%, and Caledonia Mining (NASDAQ: CMCL) lost over 10% of its value. Incidentally, several of those noted were listed on the 2022 "10 Best Junior Mining Gold Stocks To Buy" published by Insider Monkey. Usually, investors can say the list got stale. However, in the mining sector, two years should yield growth, not declines. (*Prices for comparisons calculated using 04/01/24 opening prices thru 04/30/24 intraday, Yahoo! Finance, 2:31PM EST. Some quotes may be delayed by quotation providers)

In A Perfect Storm Of Opportunity

Those performances show that not all junior miners should be treated the same. Some, like USAU, deserve the praise they're getting. In addition to investor interest, the company also announced a successful capital raise in April that injected approximately $4.9 million into its coffers. This achievement, comprising a direct offering and private placement, reflects investor confidence and underscores U.S. Gold Corp's institutional and accredited investor relationship resilience at a time when access to capital markets has tightened.

Notably, that investment does come at a time when the Federal Reserve in the United States may have pinned itself into a corner and is finding it increasingly challenging to appease markets, consumers, and companies simultaneously. While there certainly wasn't a sense of urgency to raise interest rates, as of Friday, that talk is again potentially on the table after hotter-than-expected inflation reads changed the narrative at some news desks.

While the "gold bug" news and narrative can favor USAU in the near term, COPPER is another single-word value kicker that can't be ignored. And like its forecast gold reserves, USAU may have plenty of it. In fact, according to estimates, USAU's CK Gold Project alone could hold enough copper to contribute to the buildout of at least a million electric vehicles. And remember, they would be selling into an E.V. sector that NEEDS copper to power its vehicles. More importantly, from a USAU and investor's perspective, they may serve that demand with potentially record-high prices. While it is a significant opportunity today, it's expected to get better. Bloomberg put out a note expecting copper to hit $15,000 a ton in 2025, about 53% higher than its $9,790 on April 26th. The bottom line: it's another bullish motivator for investment consideration in USAU.

Moreover, it shows that while investing in USAU for its gold interests may be appealing, buying for its copper interests could be the transformative catalyst heading into next year. Thus, don't be misled by the company name. USAU is much more than a gold play; it could also deliver a materially significant copper score and fulfill the narrative that copper may emerge as a generational trade as the E.V. sector grows into its expected $50 trillion market size by 2050.

A Sum Of Its Parts Appraisal

Indeed, there are many moving parts to factor when appraising the investment proposition into U.S. Gold. But know this- they are all accretive to a common goal of increasing shareholder value through development projects and are closer than ever to delivering above-the-ground value. Yes, there are scores of pages detailing each location's technical landscape and reserve estimates, and every investor should take the time to read and understand how they affect USAU's valuation. Find those here.

They are, after all, the roadmap showing how U.S. Gold intends to transform from "junior" to "senior" miner, expedite its mission to unearth substantial metals' value and create potentially exponential increases in shareholder value through a well-thought-out plan that capitalizes on historically proven properties to maximize revenue streams capable of dropping considerable dollars toward its bottom line. And with only about 10,732,277 company shares outstanding after its recent capital raise, positive updates could propel the next leg of its in-progress rally.

Considering the recent funding bolsters USAU's ability to advance the CK Gold Project, with upcoming milestones, including receiving its Mine Operating Plan and Closure Plan permit, some value-creating events may already be in the queue. If so, despite its 5% April run at the time of writing, USAU stock looks better than an attractive value proposition; it shows itself as a compelling one.

Disclaimers: This presentation has been created by Hawk Point Media Group, Llc. (HPM) and is responsible for the production and distribution of this content. This presentation should be considered and explicitly regarded as sponsored content. Hawk Point Media Group, LLC. has been compensated to create this content as part of a more extensive digital marketing program by an unrelated third party to the company. Accordingly, this content may be used and syndicated beyond the channels used by Hawk Point Media, Llc. This disclaimer and the link to the broader disclosures must be part of all reproductions. Receiving that referenced compensation creates a conflict of interest because the content presented may only provide a favorable viewpoint of the company featured. The contributors do NOT buy and sell securities in the companies featured. HPM holds ZERO shares and has never owned stock in Vocodia Holdings Corp. The information in this video, article, and related newsletters is not intended to be, nor does it constitute, investment advice or recommendations. Hawk Point Media Group, Llc. strongly urges you to conduct a complete and independent investigation of the respective companies and consider all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. Never take opinions, articles presented, or content provided as the sole reason to invest in any featured company. Investors must always perform their own due diligence before investing in any publicly traded company and understand the risks involved, including losing their entire investment. For the complete disclosure statement, including compensation received, click HERE.

Media Contact

Company Name: Hawk Point Media

Contact Person: Editorial Dept.

Email: info@hawkpointmedia.com

Country: United States

Website: https://hawkpointmedia.com/